Your Future, Not The Average

Transform risk management from necessary cost to growth accelerator with a simulation engine built for how businesses actually succeed.

The Ergodicity Advantage

Transform your insurance strategy with four foundational pillars

Ergodic Framework

Build your risk management strategy on the revolutionary ergodicity framework—maximizing long-term time-average growth rather than ensemble averages for sustainable business optimization.

Advanced Analytics

Leverage sophisticated Monte Carlo simulations and optimization algorithms to model complex loss distributions and understand the full spectrum of potential outcomes with statistical confidence.

Optimal Insurance Design

Design sophisticated multi-layer insurance programs with optimal attachment points, limits, and structures that maximize your company's long-term value and resilience.

Measurable Impact

Track and validate your insurance strategy performance with comprehensive reporting, backtesting frameworks, and real-time business constraint monitoring for continuous improvement.

Average outcomes don't apply to individual journeys

Traditional risk management commits a fundamental error: it assumes that the average outcome across many parallel scenarios applies to any single company's journey through time. This distinction between ensemble averages and time averages explains why businesses rationally reject positive expected value bets and why insurance creates value despite its mathematical cost.

Understanding Ergodicity

Ergodicity is the mathematical principle that distinguishes between what happens to many companies on average versus what happens to YOUR company over time. Non-ergodic systems (like real businesses) can face ruin from events that look statistically manageable, making traditional risk models dangerously misleading for individual enterprises.

First principles. Real trajectories. Actual growth.

Unlike conventional Monte Carlo simulations, which assume all paths are equally accessible, this engine recognizes that certain losses create absorbing barriers (points of no return where future opportunities vanish). Build your corporate strategy from first principles that recognize the non-ergodic nature of real business environments.

Three Ways We Transform Your Risk Strategy

Your Unique Journey, Not the Industry Average

Traditional models tell you what happens to 1,000 companies on average. We show you what happens to YOUR company over time. Our ground-up simulation engine maps your specific trajectory through multiplicative wealth dynamics, revealing opportunities and hazards invisible to conventional analysis.

From Cost Center to Catalyst

Discover precisely how insurance accelerates sustainable growth rather than just transferring risk. Our real-time ergodicity diagnostics reveal the optimal insurance coverage levels that maximize your long-term wealth accumulation while protecting against business-ending events.

Built for Your Business

Every simulation incorporates your specific operations, capital position, and risk profile. Design win-win contracts, optimize retention levels, and make decisions based on your actual constraints, not on theoretical assumptions about infinite time or capital.

Application Features

Long-Term Business Optimization

Advanced optimization algorithms that maximize long-term company value through optimal insurance decisions, using time-average (ergodic) rather than ensemble approaches.

Comprehensive Financial Statements

Familiar financial reporting formats directly from risk analysis outputs (Balance Sheet, Income Statement, Cash Flow).

Multi-Layer Insurance Tower Design

Sophisticated insurance program structuring with support for multiple layers, attachment points, reinstatements, and aggregate limits.

Advanced Risk Metrics Suite

Industry-standard risk metrics quantify tail risk exposure and support data-driven insurance purchasing decisions with confidence intervals and bootstrap analysis.

Monte Carlo Simulation Engine

Model complex loss distributions and understand the full spectrum of potential outcomes with statistical confidence.

Scenario Management & Sensitivity Analysis

Comprehensive framework for managing multiple simulation scenarios, parameter sweeps, and what-if analyses under different market conditions.

Strategy Backtesting & Walk‑Forward Validation

Robust backtesting framework that tests insurance strategies against historical and simulated data using walk-forward validation techniques.

Real-Time Business Constraints

Configurable business constraints including maximum risk tolerance, minimum ROE thresholds, leverage ratios, liquidity requirements, and regulatory compliance checks.

Executive Reporting & Visualization

Comprehensive reporting suite with interactive dashboards, Excel export capabilities, and publication-ready visualizations that translate complex analytics into actionable business insights.

See It in Action

Click images to expand

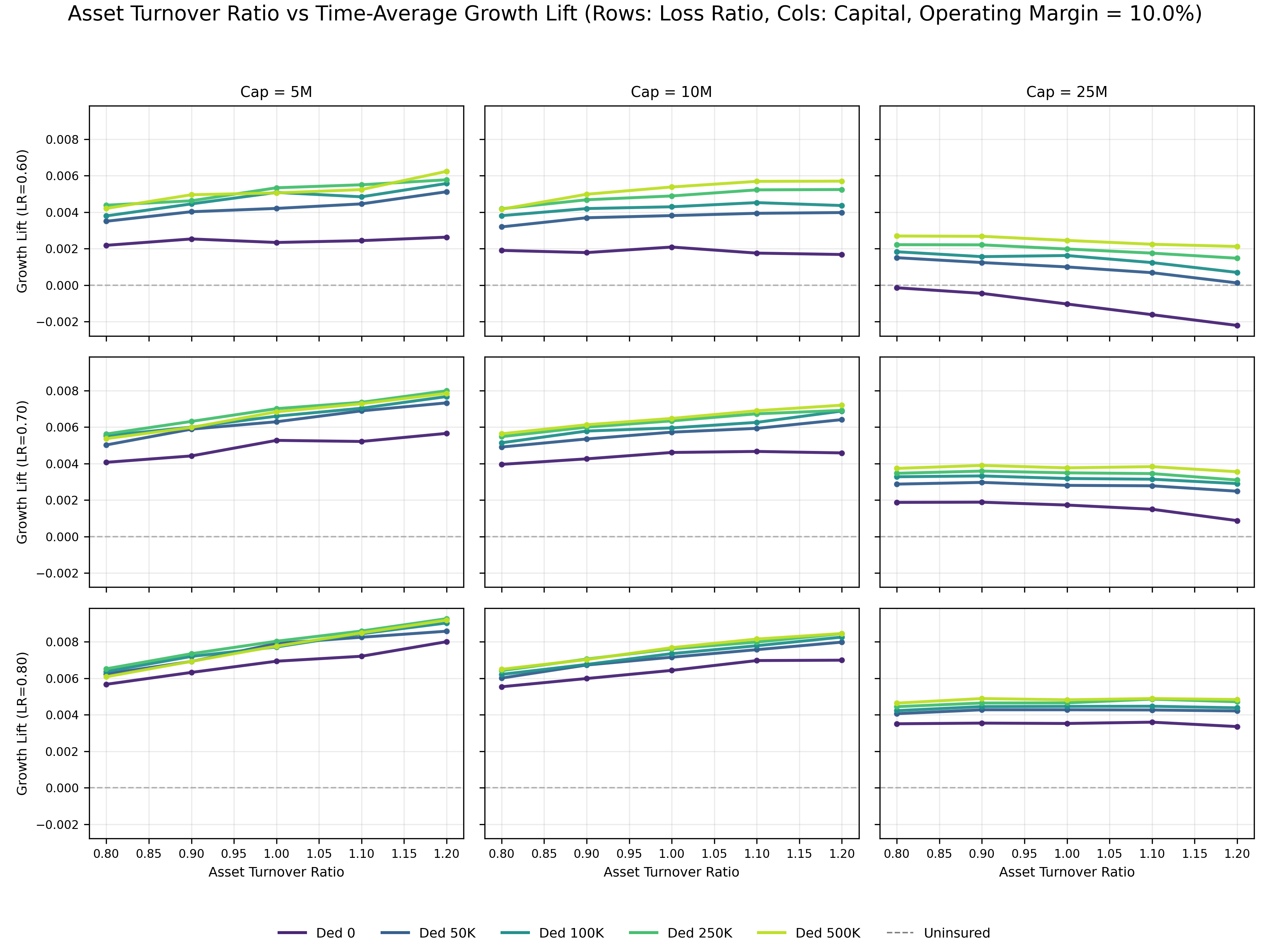

Find the deductible that balances cost and risk

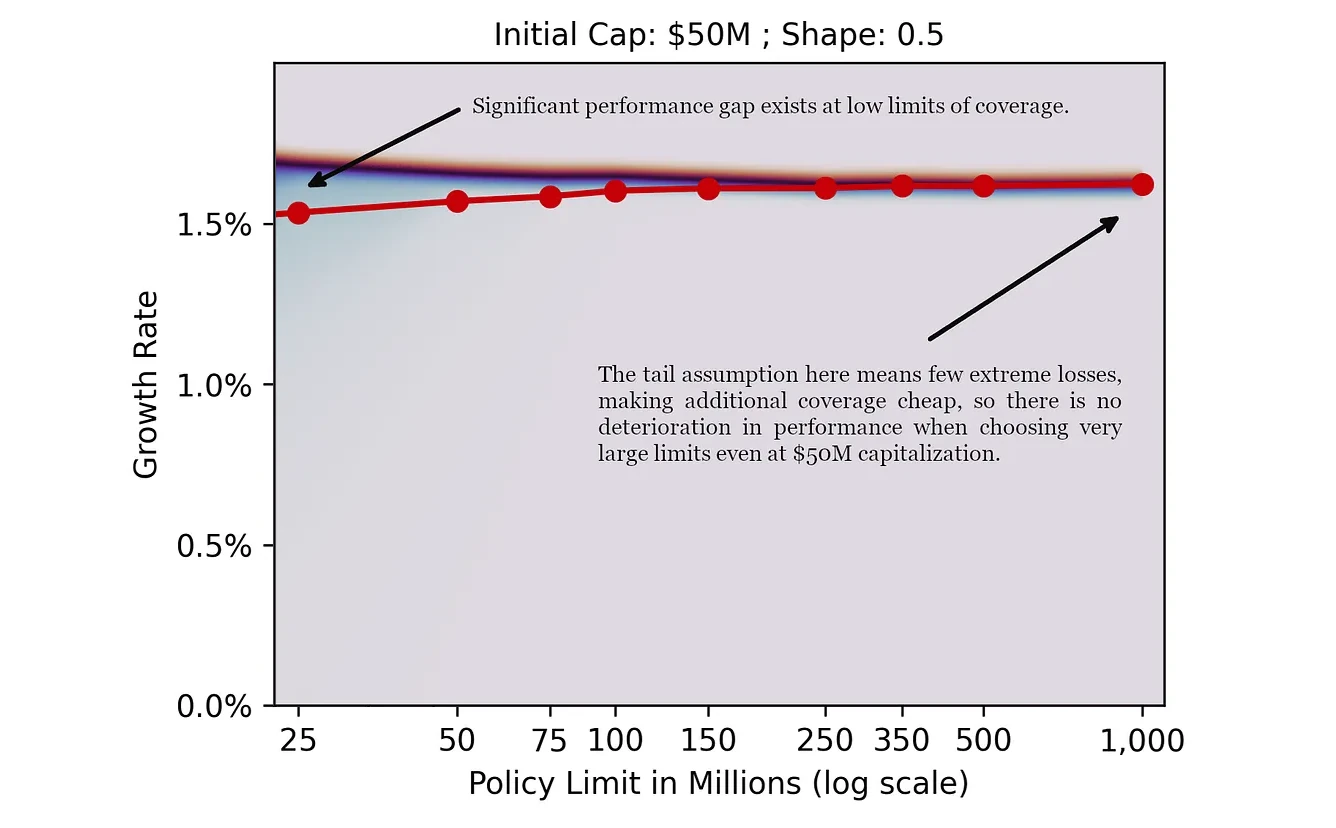

Find the limit that protects your company without overpaying

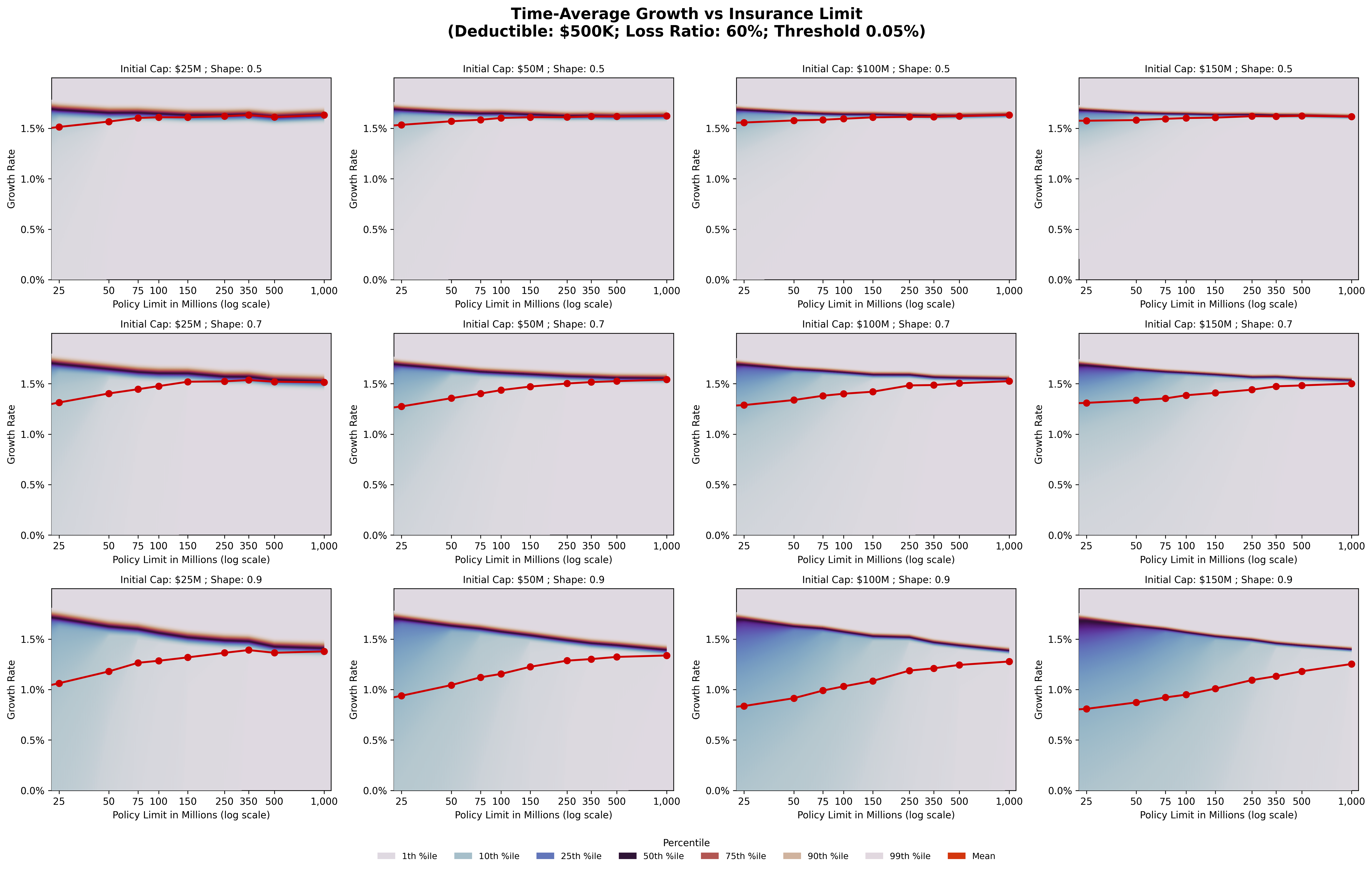

Explore which assumptions matter most for your coverage strategy

Identify strategies that stay optimal despite uncertain loss patterns

Ready to See Your True Path?

For corporate leaders ready to move beyond traditional actuarial approaches, the Ergodicity Advantage offers a scientifically rigorous yet intuitively accessible path forward.